Taking the Quantum Leap

- Adam Florence

- 6 min read

Staying at the cutting edge of technology is core to who we are at Ally. In order to provide our customers with the most comprehensive and competitive products, we strive to push the boundaries to discover what’s possible and to stay ahead of the curve. That’s why we’re excited to announce updates on our recent foray into quantum computing along with its potential applications within digital financial services. To explore this area, we’ve partnered with start-ups and other companies to experiment with this technology.

Why it Matters

Quantum computing has the potential to answer complex problems that are impossible or impractical with traditional computers. Thanks to the unique properties of superposition and entanglement, the computing potential of a quantum computer scales exponentially. This is in contrast with to traditional computers, whose computing power scales linearly, increasing 1-to-1 with the number of binary digits (bits), it has at its disposal. Quantum bits, or qubits, are not constrained by binary states. This allows the grouping of just a few hundred qubits to theoretically surpass the computational prowess of the most powerful supercomputer. Though we are nowhere close today, a quantum computer with greater than, 1 million fully functional qubits would be able to unlock a vast array of solutions to the world’s biggest problems, like those within climate change and health care.

Given this great potential, many of the country’s largest financial firms are beginning to prepare for the arrival of quantum computing. The financial services industry is full of data-rich, time-sensitive decisions where quantum solutions would pay meaningful dividends — both literally and figuratively.

Areas of substantial impact within the financial services industry include:

Portfolio optimization — Flexibility to build a portfolio best suited to meet a variety of needs. With a basket of just 100 possible assets, there are more possible portfolios than there are atoms in the visible universe, posing a challenge for traditional computational techniques. Quantum algorithms can tackle these combinatorial problems far more effectively than traditional computers can.

Risk analysis — Assessing resilience in uncertain markets. The Monte Carlo Simulation (the bedrock of risk evaluation that uses a common technique to generate a distribution of economic outcomes) is known to have a fundamental speedup through quantum computation. Harnessing this speedup would enable faster and more accurate risk analysis.

Encryption — Ensuring the safest digital environment. While future quantum computers will break state-of-the-art encryption methods such as RSA, quantum technology also enables unhackable encryption through quantum key distribution.

At Ally, we know first-hand the transformative power of new technology — it’s at the heart of everything we do — we know that’s why our clients choose Ally . Since we couldn’t wait for the quantum revolution to come to us, we decided to actively pursue and explore the potentials that quantum computing has to offer, so let us show you how.

Into the Weeds: Quantum Portfolio Optimization

Though quantum computing isn’t quite ready for primetime, we want to be ready when it is. We’re excited to announce our efforts in quantum technology and to explore how we can harness the power of quantum across our suite of financial solutions. To start off, we’re tackling one of the best near-term applications of quantum, which is portfolio optimization.

Optimization is a cornerstone application of quantum computing because the solution requires a single, best-choice from myriad possible configurations. This is where quantum computers should outshine traditional devices. To start, we must construct a valid problem and then convert it to a form that a quantum computer can solve.

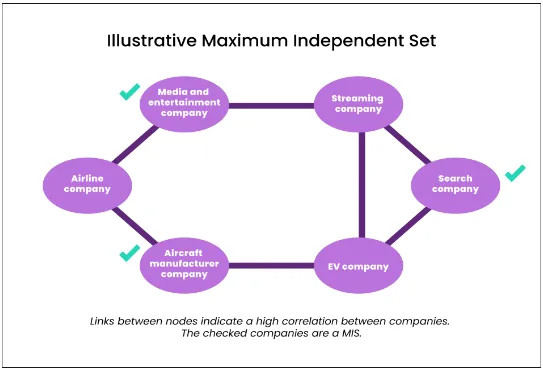

Let’s say we want to choose an optimally diversified portfolio from a universe of stocks. Given the current state of quantum computing, our universe is constrained to about 50 stocks; one per qubit. We define this as a portfolio containing the maximum number of stocks from the universe whose correlations are below a chosen threshold p. This construction is called a Maximum Independent Set (MIS). The MIS design is rather elegant. The solution will be a basket of stocks (i.e., >1) such that none are highly correlated, but those that are not chosen are highly correlated to those in the basket, giving the portfolio full coverage.

In Figure 1, we see an example of six different kinds of companies represented in the ovals. Companies are connected if their stock performance is highly correlated. For example, the media and entertainment company is highly correlated with a streaming company. In this illustration, the three companies selected, as indicated with green checkmarks, form the MIS; the selected companies are not highly correlated with each other and the companies not selected are correlated with at least one in the MIS.

To compute the MIS on a quantum computer, we form a Quadratic Unconstrained Binary Optimization (QUBO) problem. This QUBO is sent to the quantum computer for solving. The solution that is returned, would be a list of recommended stocks that make up our optimally diversified portfolio.

How do we know we have received a viable solution?

You might be thinking, “but how can we be sure that the solution is valid or correct?” “Couldn’t the quantum computer be spitting out garbage?” This is a fair question with a few near-term answers that make us comfortable. First, we are able to send our QUBO to different machines and compare solutions if we are so inclined. Additionally, at this stage, we are able to acquire simulated quantum results from traditional computers.

One day, quantum computational power will eclipse that of regular devices, but until that time, we can test our quantum setup via traditional computers. The benefit is twofold: we can assess the validity of the quantum result and show that we achieved a better outcome because of it. This may sound a little convoluted, but the regular computer isn’t finding the solution that it would generate on its own, it’s using millions of bits to mimic a few tens of qubits, thus generating a simulated quantum result. This approach will only be valid as long as the number of qubits to simulate are below a tractable level.

What does the simulation tell us?

To our satisfaction, but not necessarily our surprise, the quantum solution resulting from our recent foray into quantum computing was shown to be valid and competitive against state-of-the-art non-quantum approaches. For a number of portfolio optimization problems, the quantum result delivered the best portfolio diversification, which is a game-changing revelation. When applied across the industry, such a tool could mean thousands or even millions in individual wealth preservation, thanks to resilient portfolio construction.

In the future, we hope to equip customers with these capabilities. Individuals would have the ability to define their universe of securities, set a ceiling on correlation, and receive a fast, reliable, and powerful solution.

Reigning in the Hype

Even with the incredible promise of quantum computing, the technology has its limitations. From a consumer perspective, it is highly unlikely that quantum computers will replace devices like laptops and smartphones any time in the near future, if ever. A quantum computer does not have the ability to read data from a disk or hard drive, like your home computer does, or I/O in a quantum circuit. Even certain computations are not well-suited for quantum computing. For instance, quantum computers barely improve the time it would take to perform a Monte Carlo Simulation. In practice, the slight quadratic speedup that quantum theoretically offers is essentially erased by other factors, making regular computers more effective at this task. Thus, it is important to understand that only certain classes of problems will be viable for disruption by quantum solutions.

At this time, it is impossible to know when quantum computers will be powerful enough to deliver the results that are theoretically possible. Today’s devices are in their infancy; functional, but not yet capable of the massive improvements scientists hope to one day achieve. The real tangible progress that has been made, coupled with the significant hype this has created, obfuscates the long and unbelievably complex road that still lies ahead to building a fully functional quantum computer.

Positioning for Innovation

At Ally, we don’t like to sit around and wait to see how it all shakes out. In order to provide the best investment opportunities for our customers, we believe it is necessary to help build the future that we envision together for our community. That is why we are exploring the possibilities of quantum tools available to us today and partnering with leaders in the industry — to position ourselves at the forefront of innovation so we can better help our customers achieve their financial goals.

Interested in joining Ally's team of talented technologists to make a difference for our customers and communities? Check outAlly Careersto learn more.