Doing it right with AI: Ally’s foray into generative AI

- Sathish Muthukrishnan

- 5 min read

You can’t turn on the news without hearing about it. You can’t open your internet browser without seeing its impact.

Generative AI — also known colloquially by product names like ChatGPT or Microsoft Copilot — has been on the minds of almost every leader in many verticals. I’ve heard CIOs and CTOs say, “we’re testing ChatGPT” or “we’re exploring how to approach generative AI.”

Generative AI continues to capture interest at the highest levels of leadership, with 96% of executives saying that it is a key topic in boardroom discussions, according to an article from Business Chief. And, in a recent survey by CNBC, 47% of technology leaders said artificial intelligence is their top budget item over the next year.

Don’t be fooled. While there may be interest, and there may be (big) spend, adoption of the technology — actual deployment of it — is still in the very early stages. That’s especially true in financial services where actions don’t necessarily match the talk.

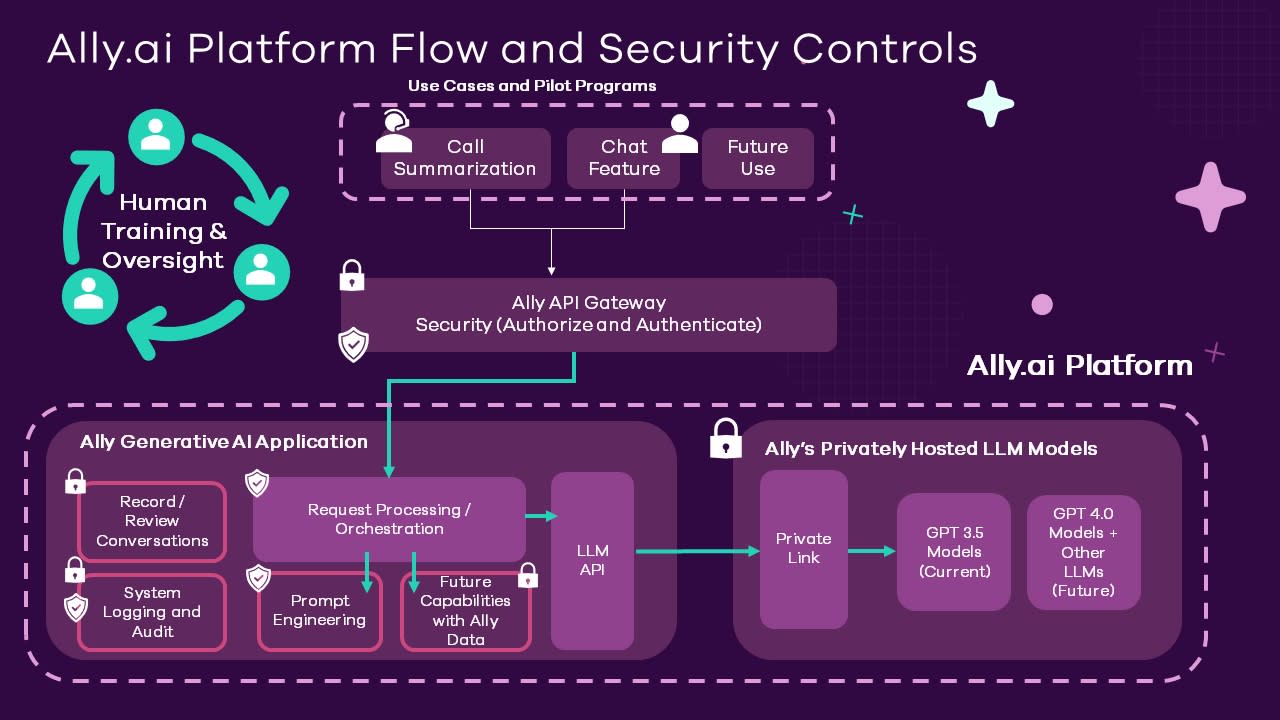

At Ally, we’re taking a deliberate, but proactive approach to capabilities around generative AI. In July, we formally launched Ally.ai — a proprietary, cloud-based platform that brings the speed and large language model (LLM) functionality of commercial AI tools together with the human touch and data security protections that are required for a financial services company. We’ve deployed other AI tools including natural language processing, machine learning, predictive analytics and computer vision. Now, we have a secure platform, built by the talented Ally Tech team, that can house all of this, and integrate any commercially available LLM.

The consensus is that generative AI has staying power. As a trusted, forward-thinking digital bank, we’re known for being on the front foot of tech exploration. But that doesn’t mean we cut corners. We want to do it right with AI, which means embedding AI seamlessly into our business and the way we work — in a responsible, collaborative and scalable manner. Our team has started with two pilot programs, one for SEO marketing and one for Customer Care and Experience, that will help us dive deep and understand how generative AI fits within our current technology landscape, security frameworks and how it might positively impact business processes.

Security and customer data privacy is in the forefront of everything we do as a digital-first organization. The entire Ally.ai platform is built on our dedicated cloud infrastructure with its own private network. Ally’s data stays private, meaning we have created a fully secured Ally environment with no external access. Steps have been taken so that Ally data is not used by others to train these foundation models. We’ve also created an AI playbook that details our use of generative AI — and creates a common platform and understanding for the entire enterprise to operate on.

In addition, we have an enterprise-wide cross functional AI Working Group at Ally who work with our AI experts to review and advise on generative AI use cases. Humans are actively trained and involved in the evaluation and use of generative AI technology. Any time we launch a pilot program or explore the use of generative AI, training and oversight mechanisms will be fully defined ahead of time. While having humans trained and involved in all aspects of generative AI work is a risk mitigation standard, there’s also another benefit. The more human feedback that Ally can accumulate, and the more we can optimize our AI models, the better AI offerings we can develop that will ultimately benefit our customers and employees.

This evolution and active usage of generative AI also maps closely with our long-term technology strategy where the experience of our customers — not our individual products — takes center stage. Generative AI has the potential to serve our customers even better by helping us understand their financial journeys more holistically, enabling a more personalized banking experience. And that’s really the point. How can generative AI make our customers’ financial experience stronger? How can it make the work that our employees do more efficient or easier?

For several weeks in June and July, more than 700 customer service associates who work with deposit customers have participated in a call summarization pilot program where the Ally.ai platform and LLM facilitates real-time summaries of customer interactions held over the phone. Feedback from our associates has been very positive around accuracy and convenience. We’re seeing that for about 82% of summaries coming back from Ally.ai, Ally associates report that they don’t require any human modification. They also report that the tool is a welcome backstop so they can focus most of their energy on meaningful customer interactions. They’ve seen increases in productivity and a lighter lift when it comes to multi-tasking — taking notes, toggling between screens, concentrating on live conversation — while taking customer calls. It’s our hope that we can shave minutes off the time it takes for an associate to document and close an interaction with a customer, which makes a better experience for all involved.

While I’ve given you just one example of the work actively happening at Ally with generative AI, the opportunities are vast. Our Auto team is looking at how the technology may be able to give real-time vehicle inventory updates via the Smart Auction platform. The Security team is exploring how AI could help our teams fighting fraud and money laundering. This is a quickly evolving technology, and if you’re standing still or just figuring out where to start, you might already be behind.

More than three years ago, Ally started building an infrastructure — centralized data and analytics, advanced public/private cloud, hardened security tools and processes — that could support emerging technologies like AI, quantum computing, and much more. We developed in-house capabilities — a deep bench of engineers that have the expertise to build a platform like Ally.ai, combined with our best-in-class security standards — to maintain and lock down the technology. I’m proud to say that the Ally team saw around corners to what AI could do for our business, and then strategically took action to meet the moment.

Generative AI has the potential to be a game-changer in financial services, especially at a pace that requires organizations to be nimble while maintaining high standards. While we continue to be prudent and cautious, we’re not standing still. Actions will speak louder than words when it comes to AI adoption and usage in banking. We’re going to continue to make moves and do it right with AI.

Interested in joining Ally's team of talented technologists to make a difference for our customers and communities? Check outAlly Careersto learn more.